St.George Mobile Banking

Description of St.George Mobile Banking

St.George Mobile Banking has been designed to give customers full banking functionality in an easy to use, intuitive and secure environment.

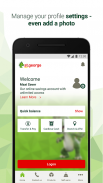

Fast login

• Fingerprint login is now available on phones with fingerprint capability and Android 6.0 or above (Android 5.0 and above for Samsung phones). For more info go to stgeorge.com.au/fingerprint. Not available on rooted devices†.

• Log in with just your security number or internet password.

Quick Zone

• View the balance of up to 3 accounts, and your recent transactions without having to log in

• Transfer money between your Quick Zone accounts.

Expense Splitter

• Paid for a shared expense? Use Expense Splitter to keep track of who’s paid you back. You can also SMS your friends what they owe you~.

Tap & Pay

• Pay with an eligible Samsung phone at contactless terminals†.

Notifications and alerts

• Choose from 7 types of alerts: Deposit, Withdrawal, Daily Balance, Low Balance, High Balance, Dishonour and Credit Card Repayment Reminder

• Receive as a notification, SMS or email. Tap Services to set up.

Cardless Cash

• Withdraw cash without your debit or credit card from any St.George, Westpac, Bank of Melbourne or BankSA ATM within Australia (daily and weekly limits apply).

Call us with Connect

• A faster way to call. No need to answer security questions as you’re already logged in~.

Payments & transfers

• Pay someone using just their mobile number

• Make transfers and payments (including BPAY®)

• Send money overseas to existing payees

• Schedule future and recurring payments.

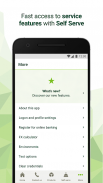

Tap the Services menu to:

• Sort or rename your accounts

• Set up notifications, SMS and email alerts

• Switch to eStatements

• Download a Proof of Balance report

• Download a 30, 90 or 120 day transaction listing report

• Update your contact details

• Decrease your credit card limit^

• Dispute a credit card transaction

• Report your card lost or stolen

• Activate your new credit or debit card

• Temporarily block transactions on your card for up to 14 days*

• Change your daily ATM/EFTPOS cash withdrawal limit for most credit and debit cards (daily limits apply)

• Tell us when you are going overseas.

ATM & Branch Locator

• Locate your nearest St.George, Bank of Melbourne or BankSA ATM or branch, and Westpac ATMs, in Australia

• Find a Global ATM Alliance ATM when overseas.

Need Help?

If you are having issues with our app, please delete and re-install it. If issues persist please call us on 1300 555 203.

Web: www.stgeorge.com.au/online-services/mobile-banking

FAQs: www.stgeorge.com.au/online-services/mobile-banking/mobile-banking-faqs

Facebook: www.facebook.com/stgeorgebankaus

Twitter: www.twitter.com/stgeorgebank

Things you should know:

†Not available on rooted devices. View compatible phones at www.stgeorge.com.au/online-services/mobile-banking/supported-devices

~Standard SMS, call or data charges apply.

^Cannot be decreased below the minimum limit. Available for personal credit cards and Amplify Business credit cards, excluding joint owned cards.

*Blocking your card will temporarily stop new transactions on your card for up to 14 days or until reactivated. The card will reactivate after 14 days if you do not cancel the card.

Some features and functions may not work on rooted devices.

Information is current at time of download and subject to change. We collect information on how you use this app for analysis of aggregate user behaviour.

You should read the Product Disclosure Statement or terms and conditions for the applicable product or service (including Mobile Banking) at stgeorge.com.au before making a decision and consider whether the product or service is appropriate for you. Fees and charges apply on certain products and services.

Samsung is a trademark of Samsung Electronics Co. Ltd.

® Registered to BPAY Pty Ltd ABN 69 079 137 518

St.George Bank – A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 and Australian credit licence 233714.</br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br>